Have A Info About How To Get A Sba Loan

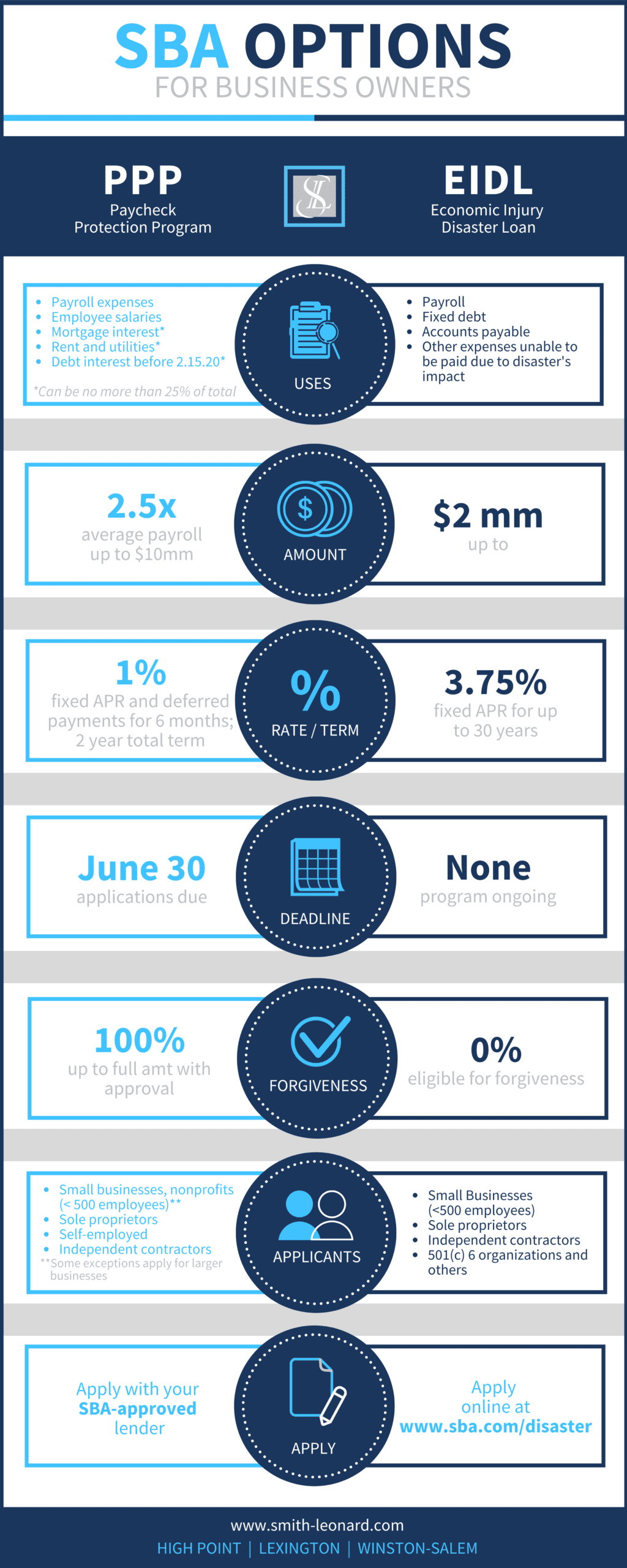

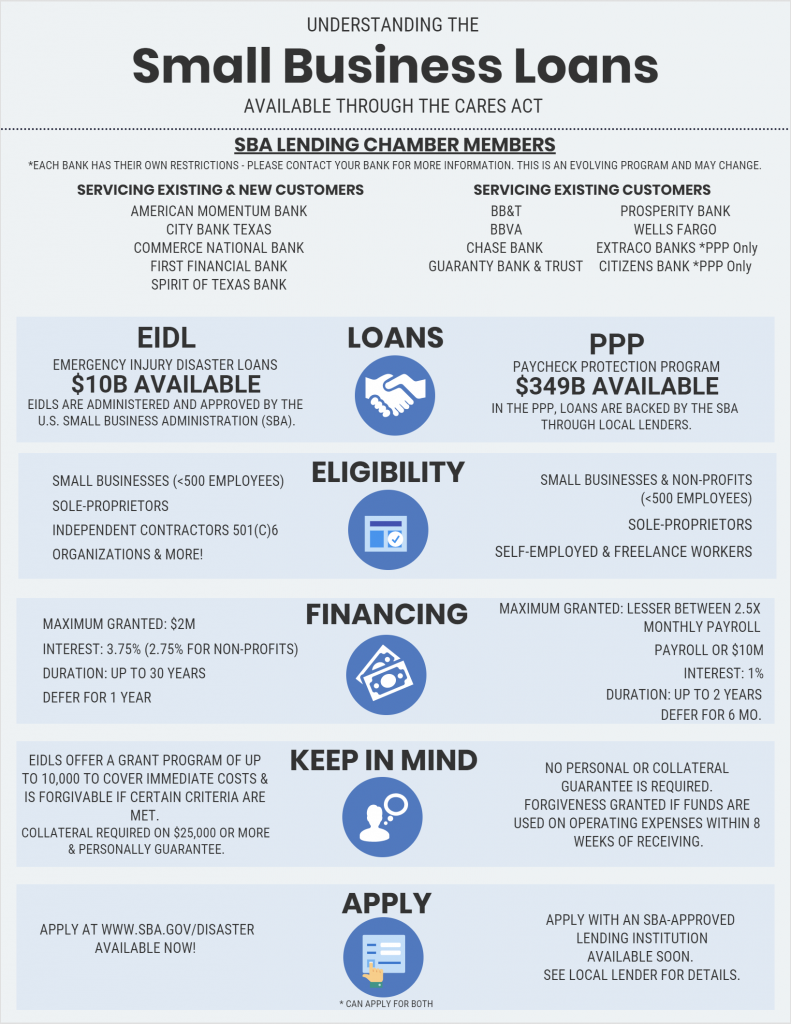

Before applying for an sba express loan, determine why your business needs cash and how.

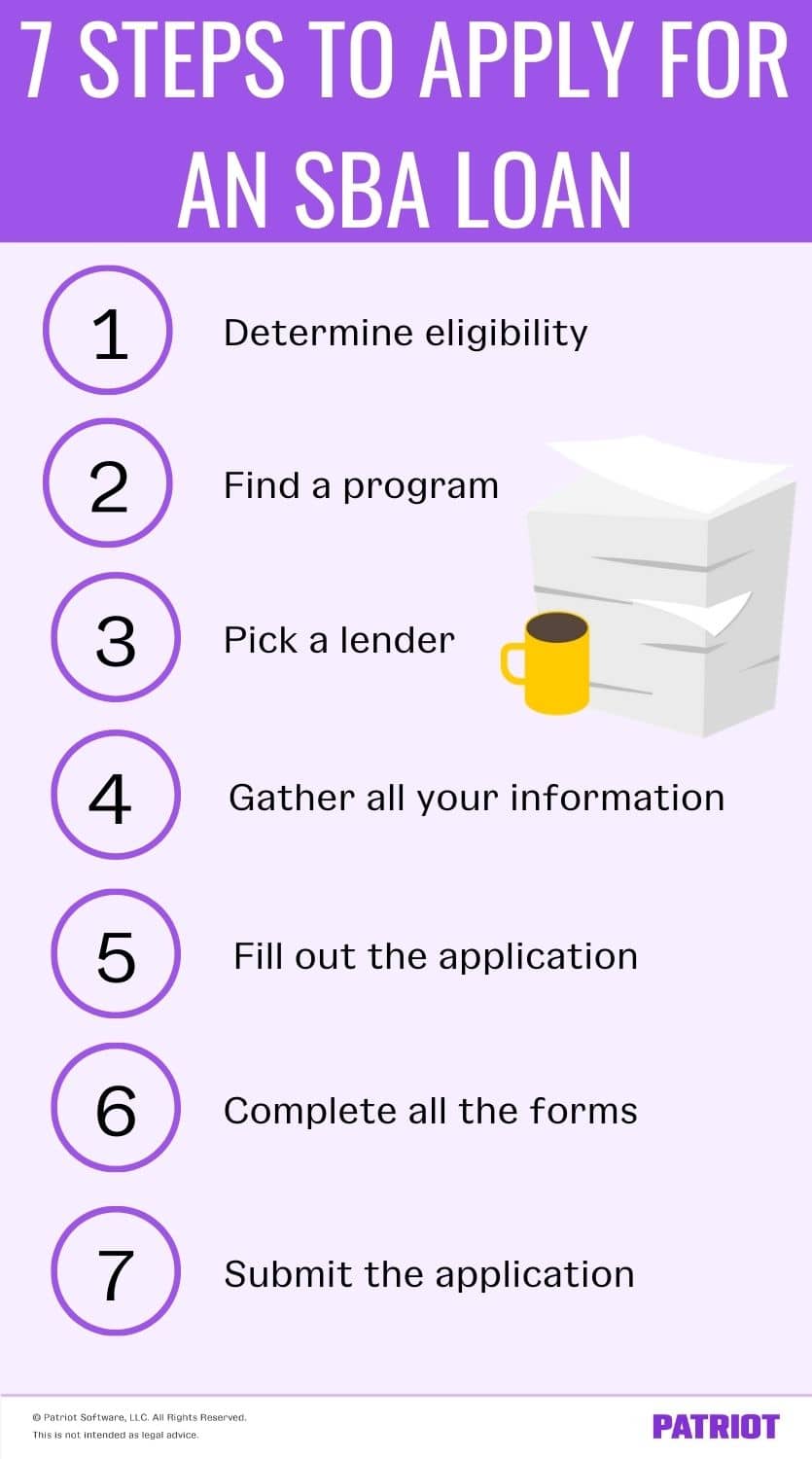

How to get a sba loan. Learn how to create a borrower account, make a payment on your sba loan, or check your account balance and due date. Low monthly payment for a $200,000 loan. Follow these steps to get an sba express loan:

Get the gold standard in small business lending. Apply, and if approved for a line of credit, enjoy flexible business funding. Ad get unsecured business loans up to $250,000 at rates as low as 5.99%.

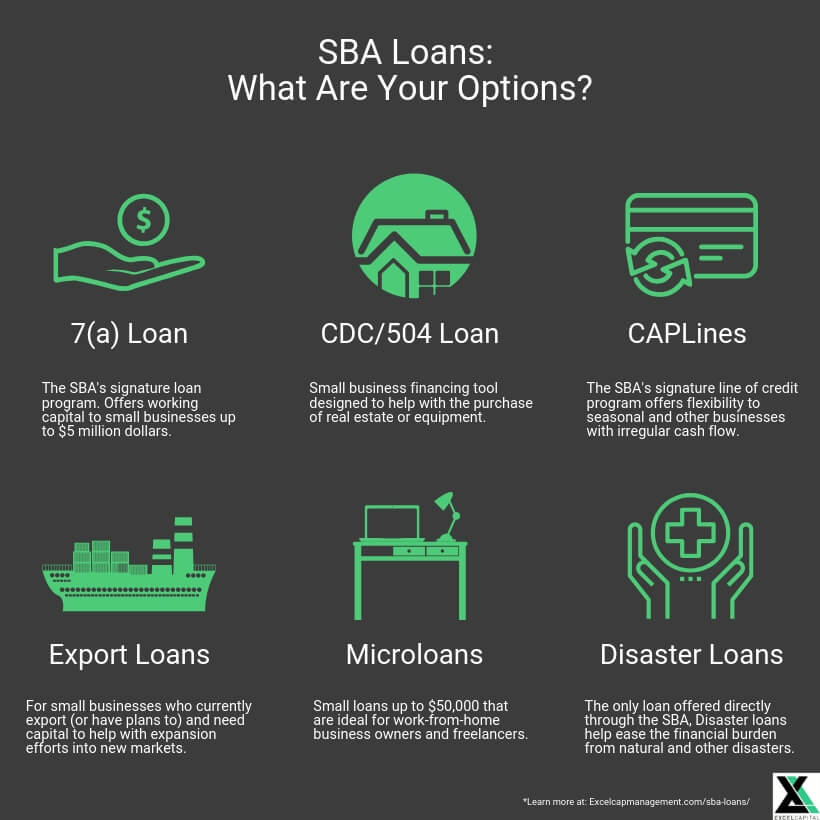

Ad apply, and if approved, use business funding today, tomorrow, anytime. Small business owners can choose from a wide range of sba loans, business loans, and lines of credit. Sba’s most common loan program, which includes financial help for businesses with special requirements.

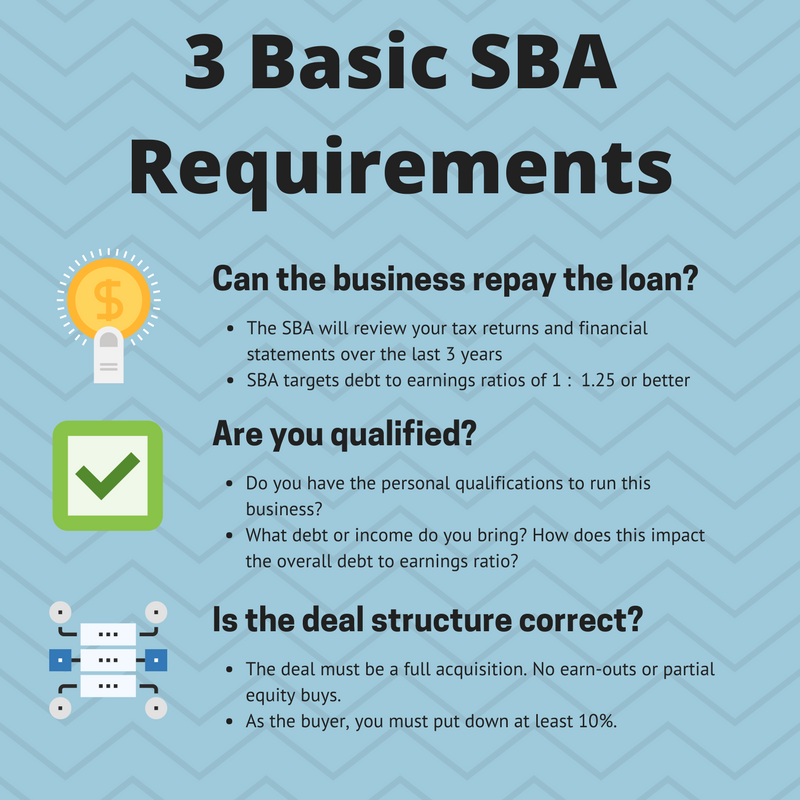

A vital component in getting a small business loan is how much revenue it brings in. Figure out if you'll qualify for an sba loan. A credit score of 680 or higher a minimum 10%.

The benefits of a repayment plan include: Fundera is not a lender itself, but a marketplace. The sba loan approval process takes 30 to 90 days from application to funding.

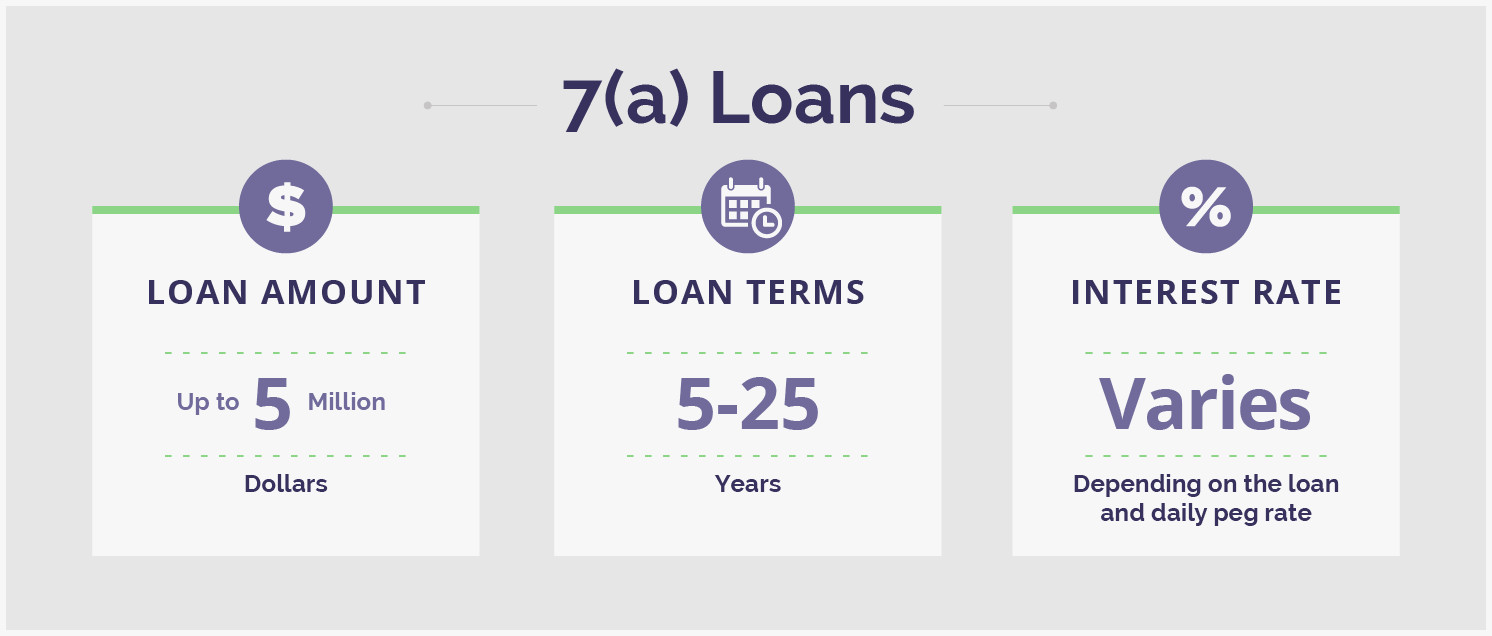

When you apply for a veterans advantage loan, you go through the standard sba 7 (a) loan process (or optionally through the sba express loan process if the loan is for. Decide what kind of sba loan. A small business loan is a great option for businesses with a good financial position and credit rating.